Couch Potato Portfolio Performance

If you can fog a mirror and divide by the number 2 or make a margarita he ll show you how to get better investment results and a better retirement with little or no effort.

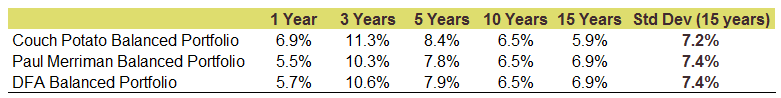

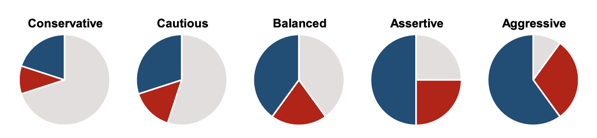

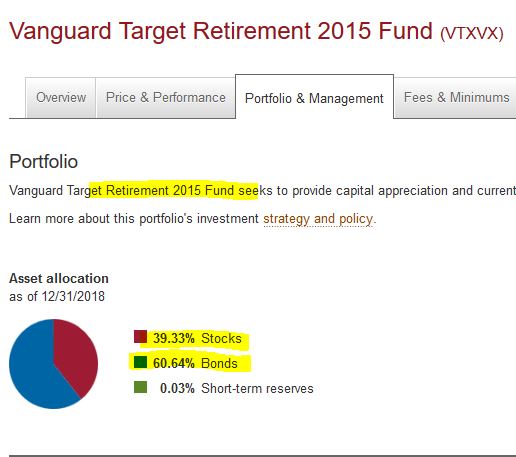

Couch potato portfolio performance. Here is how you build the couch potato portfolio. The 30 year return is 8 73. Year to date the couch potato portfolio has returned 5 52. They are is exposed to between 20 to 80 equities and 20 to 80 bonds including tips.

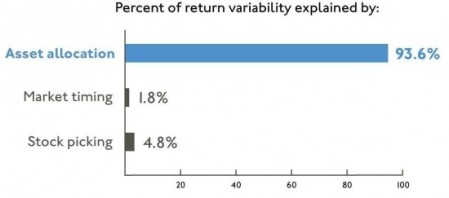

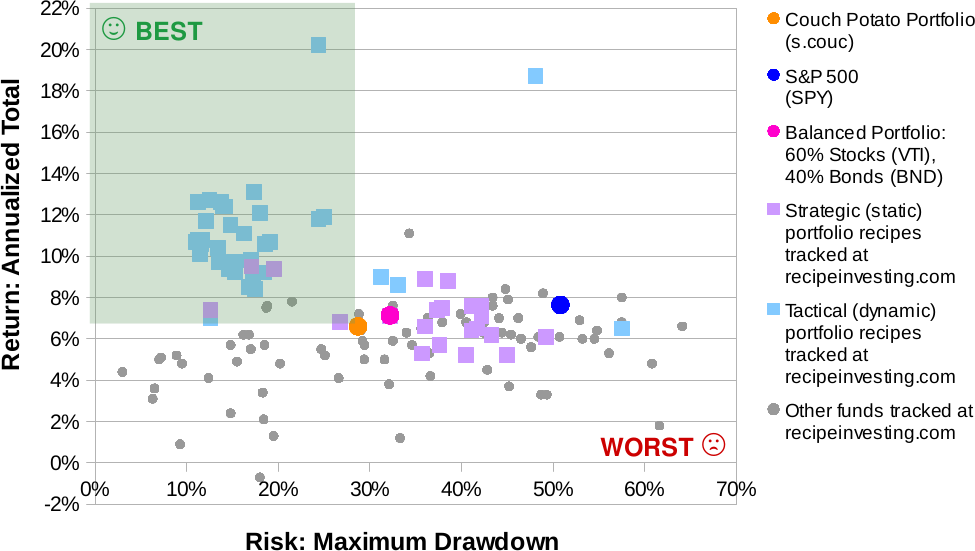

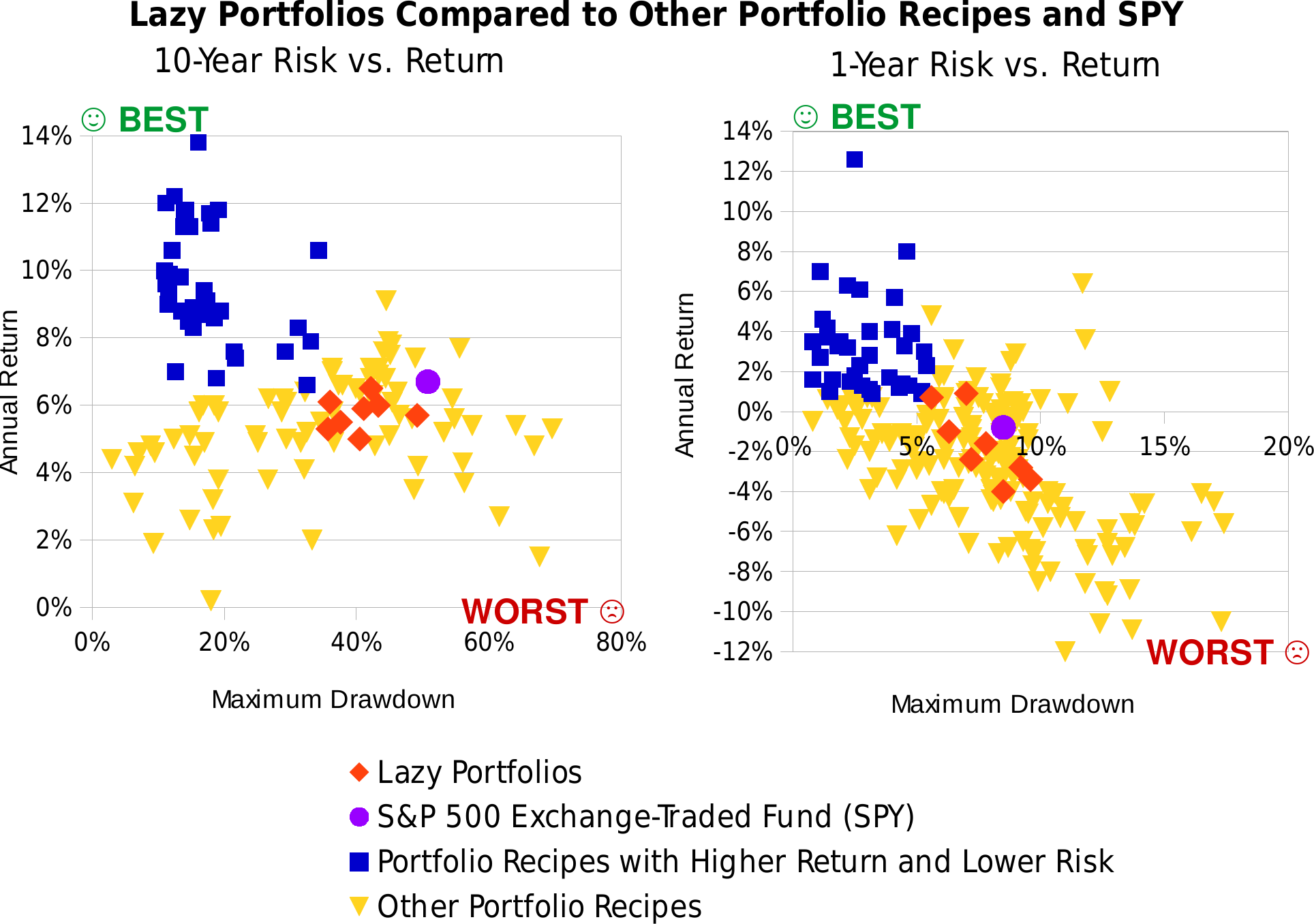

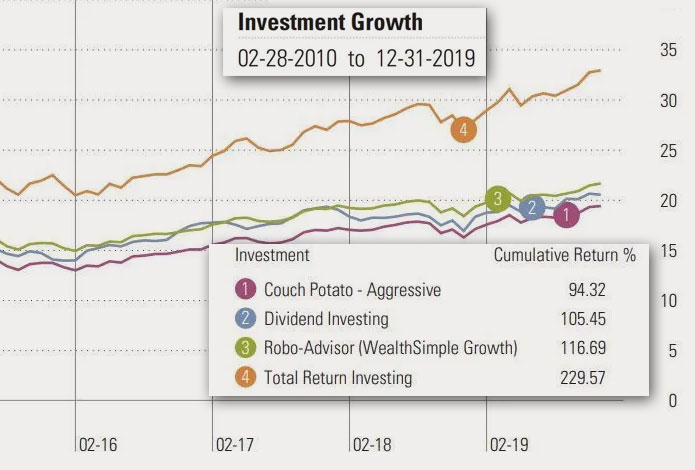

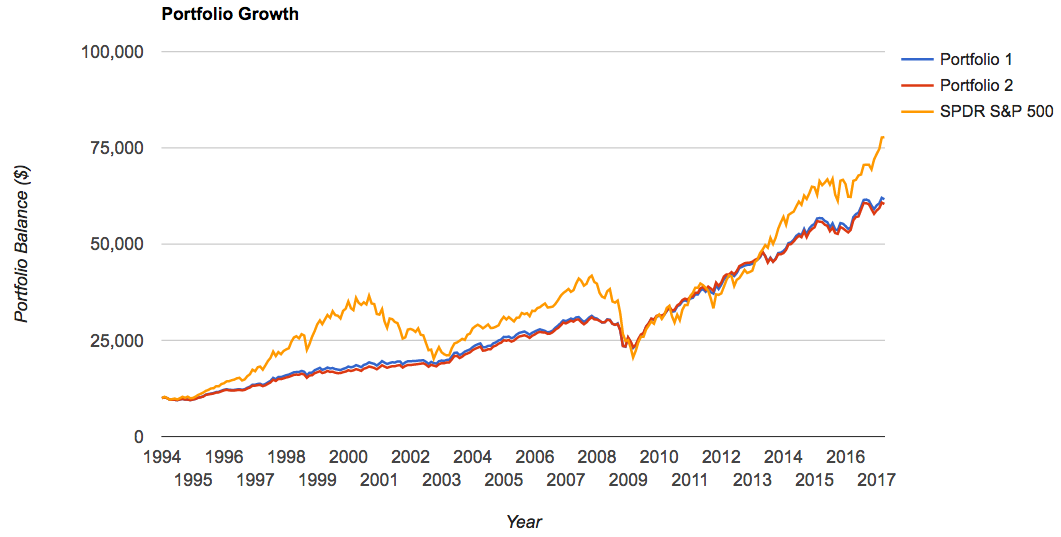

Return scatterplot using the 10 year maximum drawdown to measure risk. The average equity index returned less in the same period 11 85. Couch potato portfolios invest equally in two. The plain 50 50 couch potato portfolio returned 10 37 between 1991 and 2001.

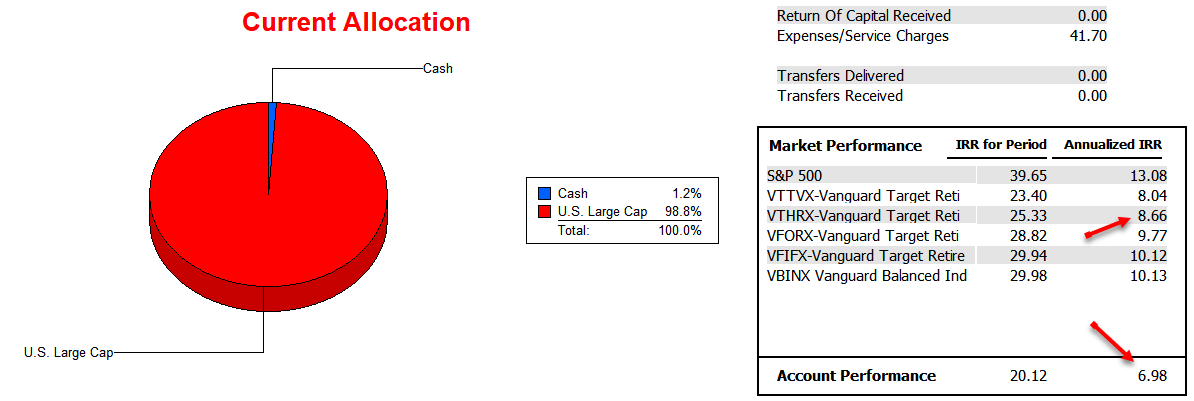

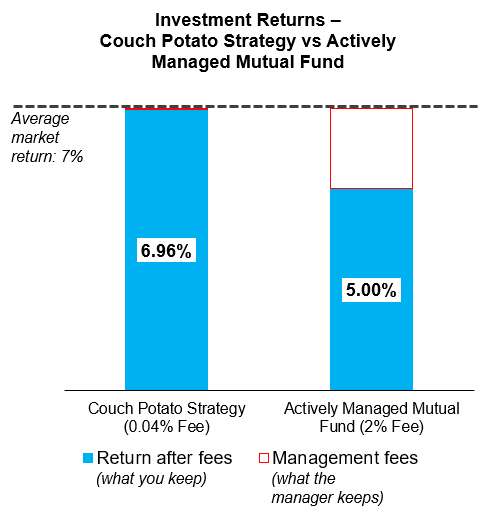

Couch potato portfolio results after inflation adjusted withdrawals for different time periods. Your typical balanced mutual fund. For the past 10 years the couch potato portfolio has returned 8 56 with a standard deviation of 9 86. The couch potato portfolio is an indexing strategy that requires only annual monitoring and rebalancing but offers significant returns in the long run.

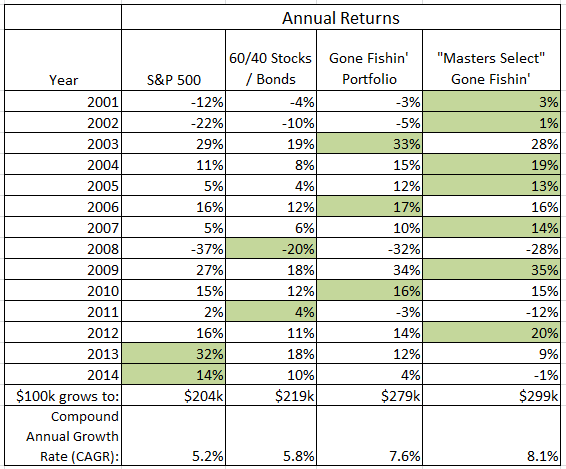

The average balanced fund returned less in the same period 9 45. Scott burns is the creator of couch potato investing and a personal finance columnist with decades of experience. 50 00 us total stock market vti 50 00 tips vtip. Investment performance figures for the global couch potato portfolio by annual nominal value 1 year return and annualized rate of return.

They are medium risk and low risk portfolios. Create a risk vs. Identify performance winners based on total return by comparing returns to the couch potato portfolio. Last year it returned 19 48.

From 1986 to 2001 the sophisticated couch potato strategy returned 12 3. The global couch potato easily beat global balanced funds. Investment performance figures for the classic couch potato portfolio by annual nominal value annualized rate of return and annual return. The dividend yield is 0 89.

Scott burns couch potato and other 8 portfolios can be built with 2 10 etfs.

:max_bytes(150000):strip_icc()/GettyImages-1164679710-1ff1c0da416c4777992f1631551550d8.jpg)