Cowlitz County Assessor S Office

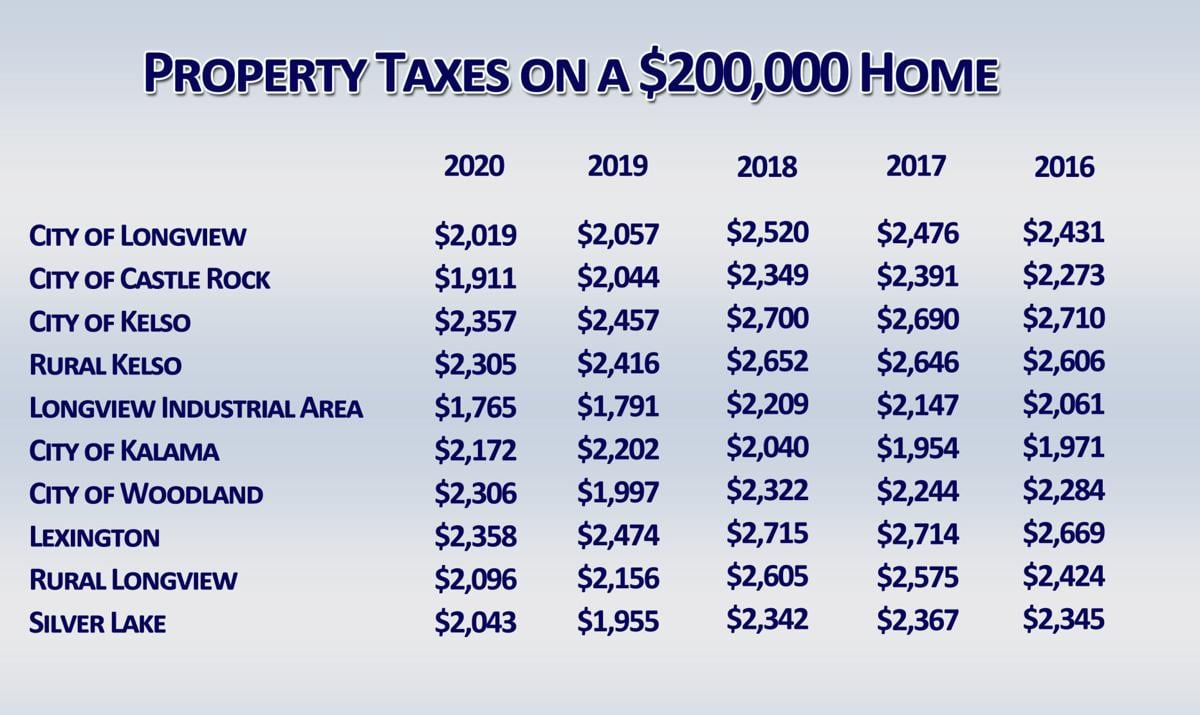

The levy rate is determined by the total assessed value of property within each taxing district.

Cowlitz county assessor s office. Assessor s office closure. If a taxing district is authorized to collect 1 000 then they will collect 1 000 regardless of the property value in the district. View all articles civicalerts aspx. Create an account increase your productivity customize your experience and engage in information you care about.

Small works roster. Washington state title 84. Appeal local board decision to the state. Annual report 2020 payable.

Property assessments performed by the assessor are used to determine the. Online planning clearance epic sign up. Neither cowlitz county nor the assessor treasurer warrants the accuracy reliability or timeliness of any information in this system and shall not be held liable for losses caused by using this information. Public property records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Cowlitz county property records are real estate documents that contain information related to real property in cowlitz county washington. Any person or entity who relies on any information obtained from this system does so at their own risk. With a balanced blend of rural and urban environments most residents of cowlitz county live about an hour from mt. Good cause waiver untimely petition.

The public is welcome to come into the auditor s office during regular business hours to access recorded documents. Employee email owa remote access vpn. District levy assd value levy rate. Portions of this information may not be current or accurate.

The assessor s office monitors and enforces these limits. Welcome to cowlitz county the land of six rivers rich in history industry natural beauty and home of the monticello convention of 1852 cowlitz county is where washington territory was born. The cowlitz county assessor s office located in kelso washington determines the value of all taxable property in cowlitz county wa. Appealing your property assessment.

Not all counties in washington utilize the digital archives database and not all of the cowlitz county auditor s records are available. 4 year levy review with voter approved. Helens the pacific. Lexington flood control zone collection history.

Public response to tdn article 2 18 2020. Cowlitz county administration building 207 n 4th avenue kelso wa 98626. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Taxing district contact information 2020 payable.

Personal property petition. County city press release regarding covid 19 virus. The value only determines the rate necessary to collect the.